Generation Black TV - Live

What Student Loan Forgiveness Means to You

Student loan forgiveness means you are no longer required to repay some or all of your loan

In August, President Biden directed the US Treasury to begin a federal student loan forgiveness program, as well as implement some significant changes. Students who received pell grants will get $20,000 in forgiveness, and those without pell grants will get $10,000. He also completely reformed the student loan payment protocols. Interest will be limited, undergraduate loans will have a lower income ratio for calculating payments, while loans for graduate school loans will remain the same.

So, what does this student loan forgiveness mean for you?

Getting forgiveness

Let’s get the basics out of the way. The first thing anyone with student loans should know is that this program does require an application through the Department of Education. The application opens in October. The pandemic pause on student loan payments will end on 31 December 2022. This forgiveness program is separate from other forgiveness programs for public service or disability. One of the changes President Biden has implemented is how the payments for other forgiveness plans are calculated, which may lead to some people getting their loans forgiven sooner.

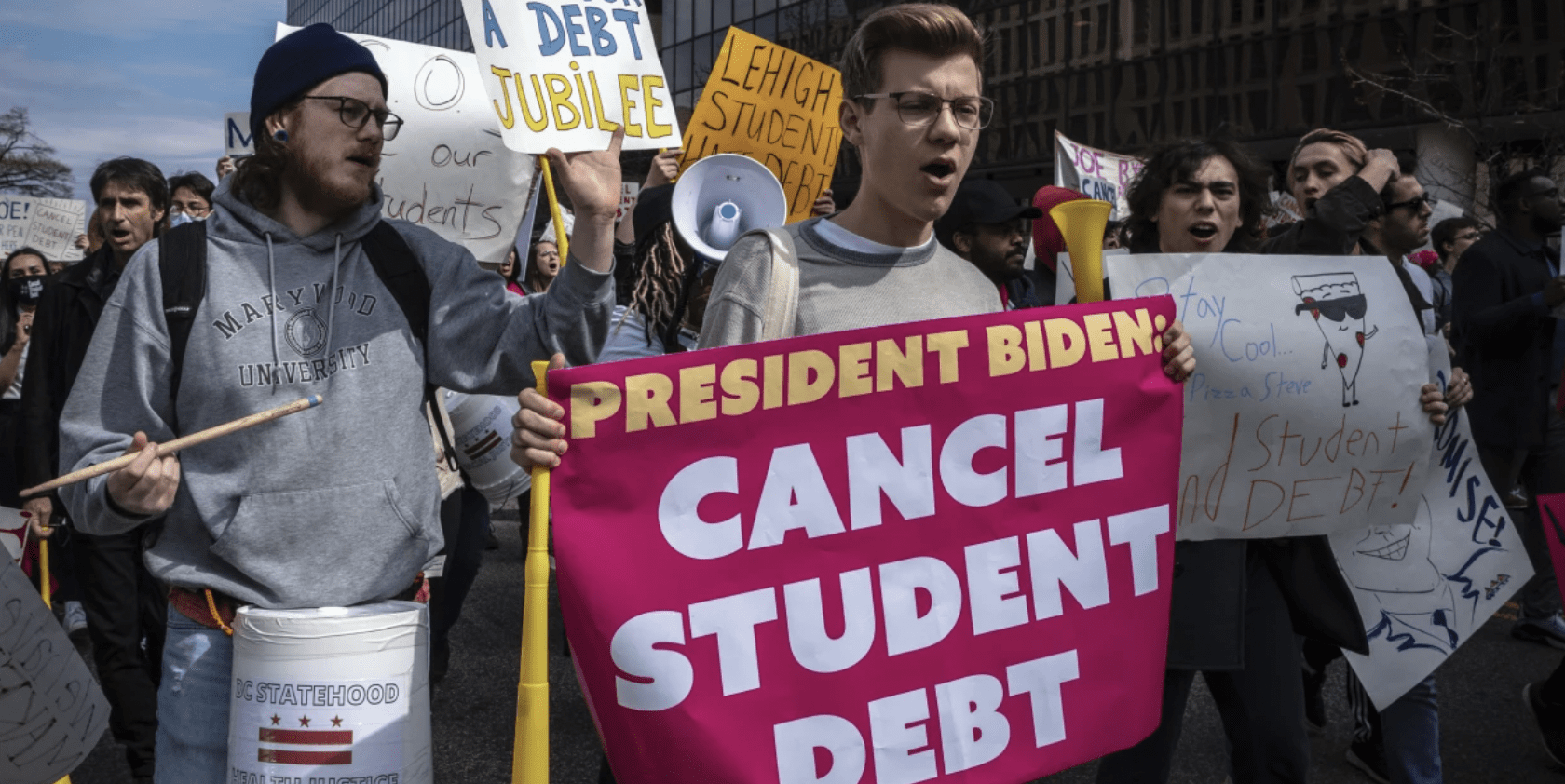

© Reuters

Politics and rich handouts

One of the criticisms of the forgiveness program is that it is essentially a handout to those who went to college and will end up richer than those who did not. However, this criticism falls flat because there are many people who went to college, and took out a loan but didn’t complete their program, leaving them in the worst possible world: debt and no degree. For many of those students, their debt will be wiped out entirely. For everyone else, a reduction in balances, better income calculations and a kinder interest rate policy will enable people to pay off their student loans faster.

Ultimately, the reason this is a good idea is that it will put money in the pockets of people who took out loans to go to college. That is where this program really shines. People will be able to buy houses and cars, pay for child care, have children return to the workforce, and stimulate the economy. With inflation the way it is right now, it doesn’t seem like the economy needs much stimulus, but given our economic headwinds, the US economy can use all the help it can get.

Obviously, Republicans have rushed to criticize the President for this move. They have predicated their critique on defending working-class people who didn’t bother to get a degree, useless or otherwise. All the usual suspects, from Ron DeSantis to Marjorie Taylor Greene and Lauren Boebert, have been front and center of their ‘disgust’ over the move. In many social media comments, the canard has been the same, why should we pay for people to get useless degrees that don’t make money? The answer is simple: it’s better for the economy. This forgiveness will be the best thing that has happened to anyone under 45 in their lifetime, at least financially.

The present student loan system is an outgrowth of rising tuition costs due to a lack of government funding for higher education. Over the past 40 years, state governments have trimmed higher education budgets. The federal government has done likewise. This means that schools had to invest in other ways to bring in revenue. Fundraising worked for some, while others chose to raise prices and spend money on amenities and perks for students that would have been unthinkable in previous decades. The reality is that until the 1990s, higher education was funded primarily by the government. Students paid very little to go to college. When that funding disappeared, tuition rose and students were forced to take out loans to cover the increasing costs.

Backlash

President Biden has already seen some backlash on this new direction for the federal student loan program. Contrary to what most people think, he did not do this via executive order, but rather a 2003 law passed by the Bush administration giving the president power to change student loans. Before 2009, the student loan system was a combination of federal government subsidized loans, grants, and unsubsidized loans through private borrowers. After the 2008 financial crisis, the Obama administration cut the private banks out of the question and the program began to be administered by the federal government through servicers like Great Lakes and Nelnet.

One of the complaints on social media is that working, non-college-educated people are now paying the $300 billion bill for student loan forgiveness. Noah Smith of the popular, ‘Noah Opinion’ substack has pointed out that Democrats may end up paying electorally for this hand-out to their base of urban, college-educated, professionals. He argues that we sent too many people to college in the first place and that many of the political problems on the Left have to do with the overproduction of elite people. He need not worry about that issue in the future: Gen Z is rejecting college in droves.

People who go to college have expectations of what happens on the other side. Education was billed as an investment. Sadly, in our modern economy, that investment really only pays off in a select few fields. Someone who took computer science or business was glad they went. Someone who took psychology but did not go to grad school but instead ended up working as an administrator in a health clinic, on a working-class salary, with essentially no pay-bump for going to college; likely feels like college was an unnecessary step onto the employment ladder and an expensive one at that.

© Getty Images

So what is Student Loan Forgiveness really all about?

Student loans and their associated costs have been a topic of national political discussion since Occupy Wall Street in 2011. 30% of Americans went to college and graduated with a degree. Unleashing millions of people from compounding interest loans will pay dividends back into the economy for decades. President Biden’s reforms will help make the system fairer. However, it does leave one problem unsolved: funding higher education. Tuition prices need to come down so that people who want to go to college can afford to do so. Most people won’t go to college, but those with the talents, chops, and ability should be able to make that investment in themselves and rise without being forced to carry the chains of the cost for the rest of their lives. This was not a controversial idea in 1975 but in today’s politics, it’s now a political football. You can bet republicans will be using this to campaign in 2022 and in 2024.